How Social Networks Boost Market Efficiency for B2B Buyers and Sellers explains how to use LinkedIn to change the rules of business development

Since the early 2000s, everyone has struggled to develop measurable economic models for social media and Web 2.0, mostly with little success. During 2007 and 2008, CSRA has worked with clients on several levels hammering out models to pass enterprise muster, and here I will briefly share one that shows considerable promise for its practicality and utility to businesses. The immediate context is B2B business development and sales, but it is applicable to numerous other enterprise processes as well.

Since the early 2000s, everyone has struggled to develop measurable economic models for social media and Web 2.0, mostly with little success. During 2007 and 2008, CSRA has worked with clients on several levels hammering out models to pass enterprise muster, and here I will briefly share one that shows considerable promise for its practicality and utility to businesses. The immediate context is B2B business development and sales, but it is applicable to numerous other enterprise processes as well.

Context: Business Development

In the B2B sphere in which many of CSRA’s clients lie, “business development” costs have been steadily on the rise since the 1990s: although salespeople often complained about the difficulty of navigating hierarchies, they are beginning to realize that the explosion of the organization into amorphous “teams” has made their profession progressively even more difficult: the organization morphs quickly. Decision making is often disjointed and unclear, with dreaded “dotted lines” stretching everywhere and wrench-bearing phantom decision makers weighing in at the last minute. Moreover, corporate sourcing groups and line executives are exerting enormous pressure on margins.

In many businesses, business development attempts to develop relationships and, based on the quality of the relationships and the firm’s expertise, the business development executive works with the client or prospect to develop opportunities of value to each party. I am generalizing greatly, but this concept is being challenged by the volatility in middle management and executive ranks: by the time the business development executive has developed the relationship and trust enough to develop business, the person in the prospect company often transitions out.

In many businesses, business development attempts to develop relationships and, based on the quality of the relationships and the firm’s expertise, the business development executive works with the client or prospect to develop opportunities of value to each party. I am generalizing greatly, but this concept is being challenged by the volatility in middle management and executive ranks: by the time the business development executive has developed the relationship and trust enough to develop business, the person in the prospect company often transitions out.

Most business development teams use processes that emerged when the business world moved much more slowly. Golfing, meals and sporting events were critical, as well as clubs, alumni events and neighbors. These are still useful tools today, but they need to be applied to a far more pre-qualified prospect that is more aligned with the firm’s unique selling proposition (USP) and strategic direction. This is where LinkedIn and other Web 2.0 venues can have a tremendous impact. Before online social networks, it was not possible to know enough about either individuals or groups of individuals to pre-qualify them appropriately.

How Social Networks Can Change the Game

Today, it is possible to get a person’s professional background in detail, as well as people s/he works with currently and has worked with/gone to school with in the past. It is possible to talk with the person’s former colleagues. Moreover, it is increasingly possible to learn some of the person’s thoughts on certain business challenges through his/her activity in online forums such as LinkedIn Answers as well as blogs (many in online mainstream media such as The Economist, CIO, CMO, Fortune, Business Week, Information World…).

Put another way, business development executives used to have to gather this information over lunch, at sporting events, etc. This represents an exorbitant transaction cost. However, Web 2.0 creates the opportunity to split off the information about the person from trust and relationship building, which is the real differentiator anyway. Each can be pursued separately to a large extent.

The EGLI Business Development Model

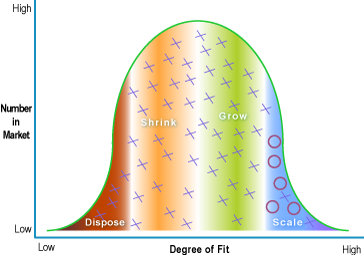

As impressive as the above tactical business development ramifications may be, the strategic importance to the firm is even larger. Because it is possible to conduct very effective due diligence on people, teams, companies and situations they are in, it is possible to change the firm’s client mix by aligning clients much more exactly with the firm’s USP. Before Web 2.0, it was not economically practical to market to the niche of prospective clients that would map closely to the USP. They are needles in haystacks that have required too many lunches and golf games. So people would compromise, and the deal was contingent on, well, getting the deal. In the bell curve, right, most of the client portfolio fits fairly well; most of the Xs are in the fat part of the bell curve. The firm has a few clients in the lower quadrants. Do you recognize any of these symptoms?

As impressive as the above tactical business development ramifications may be, the strategic importance to the firm is even larger. Because it is possible to conduct very effective due diligence on people, teams, companies and situations they are in, it is possible to change the firm’s client mix by aligning clients much more exactly with the firm’s USP. Before Web 2.0, it was not economically practical to market to the niche of prospective clients that would map closely to the USP. They are needles in haystacks that have required too many lunches and golf games. So people would compromise, and the deal was contingent on, well, getting the deal. In the bell curve, right, most of the client portfolio fits fairly well; most of the Xs are in the fat part of the bell curve. The firm has a few clients in the lower quadrants. Do you recognize any of these symptoms?

- Clients in the lower left quadrant do not fit the USP well and are often relatively expensive to serve; yet, too many firms require the revenue they provide, a vicious circle

- The same is true to a lesser degree for clients in the Shrink quadrant; they are more prone to exert cost pressure or leave for another provider, increasing churn and precipitating the need to get replacement revenue by bringing on large numbers of clients, many of which do not fit terribly well in turn

- Of course, the degree of fit is only a function of the x axis, so being in the Dispose vs. the Shrink quadrant refers to the total number of clients in the market: think of the Dispose quadrant as having a spectacularly bad fit. On the other side of the ledger, there are more clients in the market that fit generally well than that fit extremely well

- It is also important to recognize that “fit” as stated here is literal fit of strategic goals of each firm and how much each party must accommodate the other and whether such accommodation is in sync with the strategic direction, or counter to it. Separate but related is perceived fit: if the engagement executive and sponsor have not focused the agreement between client and provider, that might mean:

- The literal fit is good but the parties do not recognize it, which downgrades the relationship

- The literal fit is not good, but parties perceive it to be good, even though accommodation is counter to one or both firms’ strategy(ies)

Transforming Business Development to Drive Margin

One of CSRA’s fastest growing engagement types is helping B2B firms use LinkedIn and other Web 2.0 venues to change the client mix. To repeat, digital social networks change the economics of finding clients that map closely to your USP. In terms of the model, firms that know how to use digital social networks develop new opportunities in the lower right quadrant (the red Os). These clients demand the capabilities of the firm, and the value transferred between client and provider is maximized. Once the firm has stabilized a repeatable process, it begins rebalancing the portfolio. It gains the confidence to transition out clients on the lower left and some in the upper left. Here are some of the ways this affects profitability:

- Clients in the upper right quadrant fit better than average, so the firm is well served to study them and the cost to serve them, but this quadrant carries the danger of distracting the firm from doing the work necessary to discover, focus on and serve lower right quadrant clients

- “Red circle” clients have strategic fit with the firm, which often innovates offerings with them, adding to the significant value to both

- Scale quadrant clients often produce the most revenue per client due to the value produced for both parties

- When the firm learns how to use LinkedIn to reach out to engage clients with Scale quadrant characteristics—and it learns how to appeal to those clients so that they find firm principals—it has successfully learned how to control its destiny to a very high degree

Concluding Points

- The niche is actionable now; Scale quadrant clients can be your advocates and help you to find others in similar situations; this happens most often when you inspire the client team by consistently delivering beyond expectation and being as public as possible with results.

- Many firms do not have an operational definition of their USP, and business development is not accustomed to looking for specific clients. It is difficult not to underestimate the depth of change this represents.

- Once pilots are completed, client portfolio rebalancing will usually entail reviewing and adjusting compensation schemes to align with profit.

- For a more tactical treatment of this subject that also emphasizes LinkedIn for business development, see How Social Networks Change the Rules of Business Development and Profit.

- This is an emerging model, and I invite your thoughts and experiences.

I will be teaching some of the fundamentals of using LinkedIn for business development on the October 9 seminar in Chicago periodic public seminars.

You are right on target with the importance of laser focusing on the right prospects that mirror your company’s USP. For our firm and for our clients, it’s all about continually narrowing the prospect universe driven by the fact that we all have limited resources to direct on our target markets. Time and resources are limited in our challenging economic climate with no room to waste pointing ourselves the wrong way. Leveraging digital social networks provides us with a business development landscape we’ve never been able to so easily tap into before. Our company’s business development process steps reflect this change: we go to LinkedIn first for our pre-call research and to determine a connection path that creates value every step of the way.

I agree that scoail networks are starting to pay dividends for companies. The biz-dev area is clearly one where I have seen this. One area that we are seeing explode before our eyes is the ability of connecting to resources within one’s own organization to help salespeople have better conversations in the market. Think about it as the last mile… the marketing and biz-dev teams have teed up a lead, and now the seller needs to execute. Executing in today’s selling environment means having a good, customer centric, discovery or selling conversation. To do this well, sellers need to tap into the collective genius that exists in their company (e.g. the right case study, objection handling tip, piece of competitive info, industry insight, presentation, proposal, etc…). Using web 2.0 social networking within the company allows sellers to easily tap into the gurus that are available. At SAVO, we call this Sales Enablement. Interested people can find out more at http://www.savogroup.com

Sales people benefited from learning about companies in the Web 1.0 world. They should do the same by learning more about their their customer and prosepct contacts and decision makers in the web 2.0 world.

John, thanks for commenting. Can you site any specific dividends you’ve seen from LinkedIn–or others?

Related to “resources within the org,” I think one of the most exciting concepts for enterprises is the permeability of boundaries. Threat: hard to keep information “in here”; opportunity: salespeople can create the most efficient processes regardless of boundary.

I think the opportunity of the decade is alumni: when employees leave, some go to competitors, but many go to clients or other non-competitors. CSRA has a program to help companies create strong bonds within the org, but in LinkedIn: when employees go, they take their trusted connections with, and it’s the employer’s job to make sure plenty of those connections hook back to the company, precipitating opportunities. Thoughts?

Kathy, thanks for sharing. Have you guys tried to quantify the impact of using LinkedIn during pre-qualification? Have you considered taking it a step further by creating an offer to engage people in LI Answers? How can you use LI to innovate at each step of your methodology?

Paul, I couldn’t agree more. How do you see healthcare comparing to other industries in terms of adoption?

[…] networks significantly reduce the cost of communication and relationship building. In How Social Networks Make Markets More Efficient for Buyers and Sellers, I showed how this affects profits. At this point, if you recognize social networks’ value […]

[…] networks significantly reduce the cost of communication and relationship building. In How Social Networks Make Markets More Efficient for Buyers and Sellers, I showed how this affects profits. At this point, if you recognize social networks’ value […]

[…] metrics for your pipeline; 2) need to scale the activity to various parts of the business; 3) rationalize client portfolio, replacing “Dispose” clients with “Grow” clients; 4) higher profitability; […]

[…] a dinosaur. But sales needs to develop quantitative metrics for trust development (here’s one mind-expanding example and a social business lifecycle […]

[…] How Social Networks Boost Market Efficiency for B2B Buyers and Sellers LinkedIn ROI Success: Corporate Development: Mergers & Acquisitions […]