Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter. Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The point remains, imagination and inertia are preventing financial services firms from engaging with clients and prospects in digital social venues, not regulators. Here’s how it’s done.

[…]

Social Channel Three: Using the Social Channel to Defend Native Markets and Penetrate Foreign Markets

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value. The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value.

The blade cuts both ways: the home court advantage will make exporting to emerging markets much more difficult in the years ahead. The Social Channel will raise the bar because users in all markets will increasingly expect brands to relate to them and to solicit their input and advice. Brands will have to invest significantly in developing in-market social […]

Social Channel Two: Understanding the Social Channel of Value by Examining Its Precedents

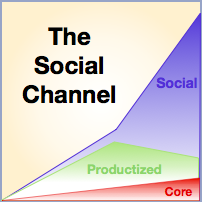

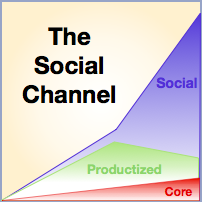

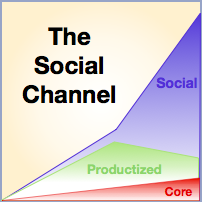

Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them. Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them.

The Social Channel is the Knowledge Economy‘s analog to the Industrial Economy’s assembly line, which led to today’s brands and mass-produced products. Where the assembly line made fabrication ten times more efficient, digital social technologies will boost human communication and sociality by an order of magnitude. The “Social Channel of Value” shows how product and service features will […]

Here’s a useful financial services social business example from Forbes. It details how a Midwest financial services firm grew at competitors’ expense by using LinkedIn, Twitter & legacy communications. Here’s a useful financial services social business example from Forbes. It details how a Midwest financial services firm grew at competitors’ expense by using LinkedIn, Twitter & legacy communications.

Notice that Jefferson, an investments firm, engaged its channel (financial advisors), using LinkedIn, YouTube, Twitter and legacy marcom. Their momentum enabled them to maintain their pricing while competitors felt compelled to lower theirs.

Another powerful lesson is, during “downturns,” don’t follow the herd and cut sales and marketing investments, especially when you can use social business to magnify impact as Jefferson did. Well done! #li

Continuing the social business Engaging Times Summit, Donna shared Western Union’s social media journey thus far and where they are going. They are still in the early stages, having been limited by regulation (in the financial services industry). Spun off from erstwhile parent First Data in 2006, Western Union has more room to maneuver, and its CEO and CMO have become social media enthusiasts. Continuing the social business Engaging Times Summit, Donna shared Western Union’s social media journey thus far and where they are going. They are still in the early stages, having been limited by regulation (in the financial services industry). Spun off from erstwhile parent First Data in 2006, Western Union has more room to maneuver, and its CEO and CMO have become social media enthusiasts.

[…]

Over-Publicized Problems and Unusual Opportunities—A Way to Monetize Collaboration?

Financial Markets World held its conference, Web 2.0/Enterprise 2.0 in the Capital Markets Industry, in New York City on 17 September 2007. Invited as a panelist on the bleeding edge track, “Web 3.0: Where Are We Going,” I nonetheless had time to scribble some notes to cover some of the sessions. Financial Markets World held its conference, Web 2.0/Enterprise 2.0 in the Capital Markets Industry, in New York City on 17 September 2007. Invited as a panelist on the bleeding edge track, “Web 3.0: Where Are We Going,” I nonetheless had time to scribble some notes to cover some of the sessions.

Enterprise 2.0 is being adopted by investment banks and the capital markets industry, but adoption is being dampened by two flies in the ointment: 1) the industry is highly regulated, and compliance forces firms to have control of their data, which means CIOs are hesitant to try new technology that may introduce risk; 2) enterprise 2.0 doesn’t yet have a locked and loaded business case. It’s early, and all conference sessions reflected that.

The Global Human Capital Journal’s coverage comprises summaries of all the sessions, as well as more in-depth coverage of three of the sessions. To access all the articles in one click, use the Financial Markets World tag. This article contains the summaries as well as my analysis and conclusions of […]

Adoption Weakened by Compliance Risk and “So Obvious It’s Invisible” Value Proposition

The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Dion Hinchcliffe, a leading writer and consultant in Web 2.0 and Enterprise 2.0, described how capital markets firms were adopting Enterprise 2.0. After some general points on enterprise 2.0 adoption, he referenced early work of Dresdner Kleinwort, AOL, T. Rowe Price, Wells Fargo and JP Morgan. As usual, I’ll summarize his remarks before sharing my analysis and conclusions. The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Dion Hinchcliffe, a leading writer and consultant in Web 2.0 and Enterprise 2.0, described how capital markets firms were adopting Enterprise 2.0. After some general points on enterprise 2.0 adoption, he referenced early work of Dresdner Kleinwort, AOL, T. Rowe Price, Wells Fargo and JP Morgan. As usual, I’ll summarize his remarks before sharing my analysis and conclusions.

Dion has collaborated repeatedly with O’Reilly, the folks who officially coined the term “Web 2.0” and hold one of its most well attended conferences. He began his presentation with the definition of Web 2.0: (using) “networked applications that explicitly leverage network effects.” In my view, that means purposely leveraging P2P (peer to peer) technology. They scale exceptionally quickly because they are easy to use, people who like to use them do so on their own time and for their […]

Growing Collaboration Culture Will Force Compliance Breakthroughs—Moving to London

The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Eran Barak, Global Head of Strategy for Reuters, moderated a discussion with panelists David P. Olener, Director Legal Discovery Solutions at Orchestria, and Warren Roy, President & CEO of Global Relay Communications. They are well qualified to discuss this topic: As a former litigator, Olener has extensive experience with complex discovery and has consulted to numerous Fortune 100 clients in compliance, security and risk management. Roy’s company is a hosted compliance archiving and messaging suite used by over 1,200 financial and legal firms for regulatory purposes. The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Eran Barak, Global Head of Strategy for Reuters, moderated a discussion with panelists David P. Olener, Director Legal Discovery Solutions at Orchestria, and Warren Roy, President & CEO of Global Relay Communications. They are well qualified to discuss this topic: As a former litigator, Olener has extensive experience with complex discovery and has consulted to numerous Fortune 100 clients in compliance, security and risk management. Roy’s company is a hosted compliance archiving and messaging suite used by over 1,200 financial and legal firms for regulatory purposes.

Their consensus was that enterprise 2.0, notably IM (instant messaging, chat) introduces significant issues with highly regulated financial services firms. Although this is widely known, many of the details of how the technologies can pose problems were illuminating. We will provide a summary of the panel before adding our insights.

Enterprise 2.0 Technologies and Regulatory Issues IM is […]

A Glimpse Inside the Emerging Divide between Wall Street Professionals—How Many Goldman Employees Are on Facebook?

The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Tom Steinthal of the BSG Alliance wrapped the conference by crystallizing several Web 2.0 concepts with passion and panache. Tom is Managing Director of BSG Alliance’s Financial Services practice. Previously he has managed equities technology teams at Goldman Sachs, Donaldson, Lufkin & Jenrette, Credit Suisse, JPMorgan Chase and Prudential. Further back, he led Nasdaq technology teams and designed and implemented Nasdaq trade order management and market making systems. He has been a member of various Nasdaq and NASD technology committees and has been Series 7, 3 and 55 licensed. The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Tom Steinthal of the BSG Alliance wrapped the conference by crystallizing several Web 2.0 concepts with passion and panache. Tom is Managing Director of BSG Alliance’s Financial Services practice. Previously he has managed equities technology teams at Goldman Sachs, Donaldson, Lufkin & Jenrette, Credit Suisse, JPMorgan Chase and Prudential. Further back, he led Nasdaq technology teams and designed and implemented Nasdaq trade order management and market making systems. He has been a member of various Nasdaq and NASD technology committees and has been Series 7, 3 and 55 licensed.

Wall Street firms will increasingly get caught up in several threads of culture change, but he emphasized two: the generational divide and, related to it, collaboration vs. control. In this context, “building an enterprise 2.0 system ’employees’ will use” must take into account very different styles of working and […]

Just Released—CSRA Market Advisory Highlights How I-Banks are Using Web 2.0 to Drive Competitiveness

![Enterprise 2.0 A Game-Changer for Investment Banks [Market Advisory]](http://rollyson.net/wp-content/uploads/2007/09/Mkt_Advisory.gif) This summer, “Enterprise 2.0” began to get legs as the new moniker for applying Web 2.0 to the enterprise, reflecting that pragmatists are raising their eyes for an exploratory glance. The market advisory shares how global investment banks are using Enterprise 2.0, and it suggests action steps for executives to take this year and next. Here is the executive summary and a few choice concluding points: This summer, “Enterprise 2.0” began to get legs as the new moniker for applying Web 2.0 to the enterprise, reflecting that pragmatists are raising their eyes for an exploratory glance. The market advisory shares how global investment banks are using Enterprise 2.0, and it suggests action steps for executives to take this year and next. Here is the executive summary and a few choice concluding points:

Enterprise 2.0 Enables Executives to Digitize and Monetize Collaboration for the First Time

This is so simple that many will miss it and open themselves to disruptive competition…

Banks increasingly use wikis, blogs and other Web 2.0 tools for mission-critical processes, as shown through the examples of Citi, DrKW, Morgan Stanley, ING and JP Morgan.. Enterprise 2.0 is a new term that denotes corporate adoption of Web 2.0 and social software tools. It offers investment banks an unusual opportunity to reduce risk and improve their earnings and profits by increasing returns on process, human and knowledge capital. However, Enterprise 2.0 also confronts banks […]

|

|

![]() Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value.

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value. Here’s a useful financial services social business example from Forbes. It details how a Midwest financial services firm grew at competitors’ expense by using LinkedIn, Twitter & legacy communications.

Here’s a useful financial services social business example from Forbes. It details how a Midwest financial services firm grew at competitors’ expense by using LinkedIn, Twitter & legacy communications. Financial Markets World held its conference, Web 2.0/Enterprise 2.0 in the Capital Markets Industry, in New York City on 17 September 2007. Invited as a panelist on the bleeding edge track, “Web 3.0: Where Are We Going,” I nonetheless had time to scribble some notes to cover some of the sessions.

Financial Markets World held its conference, Web 2.0/Enterprise 2.0 in the Capital Markets Industry, in New York City on 17 September 2007. Invited as a panelist on the bleeding edge track, “Web 3.0: Where Are We Going,” I nonetheless had time to scribble some notes to cover some of the sessions. The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Dion Hinchcliffe, a leading writer and consultant in Web 2.0 and Enterprise 2.0, described how capital markets firms were adopting Enterprise 2.0. After some general points on enterprise 2.0 adoption, he referenced early work of Dresdner Kleinwort, AOL, T. Rowe Price, Wells Fargo and JP Morgan. As usual, I’ll summarize his remarks before sharing my analysis and conclusions.

The Global Human Capital Journal’s coverage of Financial Markets World’s Web 2.0 in the Capital Markets Industry conference continues. In this session, Dion Hinchcliffe, a leading writer and consultant in Web 2.0 and Enterprise 2.0, described how capital markets firms were adopting Enterprise 2.0. After some general points on enterprise 2.0 adoption, he referenced early work of Dresdner Kleinwort, AOL, T. Rowe Price, Wells Fargo and JP Morgan. As usual, I’ll summarize his remarks before sharing my analysis and conclusions.