When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment. When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment.

[…]

How to Outperform by Managing the Social Business Risks that Slow Your Competitors

By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment. By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment.

[…]

Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter. Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The point remains, imagination and inertia are preventing financial services firms from engaging with clients and prospects in digital social venues, not regulators. Here’s how it’s done.

[…]

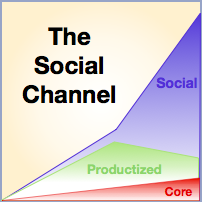

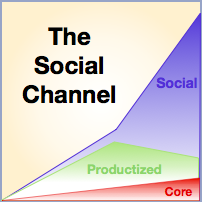

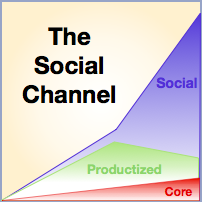

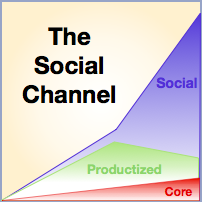

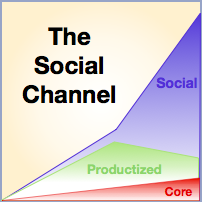

The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship. The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship.

Since the Social Channel is so important, I have published the Social Channel Trilogy, which is summarized here. Find even more information on the Social Channel home page.

[…]

Social Channel Three: Using the Social Channel to Defend Native Markets and Penetrate Foreign Markets

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value. The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value.

The blade cuts both ways: the home court advantage will make exporting to emerging markets much more difficult in the years ahead. The Social Channel will raise the bar because users in all markets will increasingly expect brands to relate to them and to solicit their input and advice. Brands will have to invest significantly in developing in-market social […]

Social Channel Two: Understanding the Social Channel of Value by Examining Its Precedents

Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them. Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them.

The Social Channel is the Knowledge Economy‘s analog to the Industrial Economy’s assembly line, which led to today’s brands and mass-produced products. Where the assembly line made fabrication ten times more efficient, digital social technologies will boost human communication and sociality by an order of magnitude. The “Social Channel of Value” shows how product and service features will […]

Social Channel One: Building Post-Product Relationships with Customers is how to Build Brands

Pioneering brands are building post-product customer relationships in the social channel because they realize that product features are copied easily and serve as weak differentiators, which leads to pervasive commoditization. Moreover, people’s preferences for individualized information dealt mass media a lethal blow, and products firms will have a similar fate. Here’s why products will become extinct and how to guide your brand in building post-product customer relationships and profits. Pioneering brands are building post-product customer relationships in the social channel because they realize that product features are copied easily and serve as weak differentiators, which leads to pervasive commoditization. Moreover, people’s preferences for individualized information dealt mass media a lethal blow, and products firms will have a similar fate. Here’s why products will become extinct and how to guide your brand in building post-product customer relationships and profits.

I have predicted for years that mass customization would be the fate of “products,” and social business is bearing this out in spades, so here I’ll delve into how impersonal “products” will be rejected by customers in 5-15 years. More important, CMOs and brand stewards who appreciate this transformation will enjoy unusual advantage, and smart ones will prepare for it now. Brands that don’t get it will simply perish, and no one will even notice except their producers and vendors. Just think about the local papers and TV stations you have known.

This is Part One […]

This week Twitter and LinkedIn canceled their agreement for easy cross-posting, which begot numerous indignant comments from people who seemed to have forgotten that they were using free infrastructure. Social business platforms are built and managed by venture-backed firms that need to execute on evolving business models, so we can all expect sudden changes from any and all. However, with some foresight and preparation you and your firm can minimize disruptions, which we’ll cover here. Even better, the LinkedIn-Twitter dustup provides strategic insights into how to operate within the digital social ecosystem, and we’ll address those, too. This week Twitter and LinkedIn canceled their agreement for easy cross-posting, which begot numerous indignant comments from people who seemed to have forgotten that they were using free infrastructure. Social business platforms are built and managed by venture-backed firms that need to execute on evolving business models, so we can all expect sudden changes from any and all. However, with some foresight and preparation you and your firm can minimize disruptions, which we’ll cover here. Even better, the LinkedIn-Twitter dustup provides strategic insights into how to operate within the digital social ecosystem, and we’ll address those, too.

[…]

I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”). I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).

In this context, government usually lies between nonprofits and brands because it’s not commercially focused (advantage), but it rarely considers individuals in meaningful ways (disadvantage). Here I’ll lay out the rationale for these claims before giving some practical pointers for unlocking social business potential by understanding the social good of your business. Brands and governments, you can learn from this, too.

[…]

How Brands Cut Their Exposure to Facebook Business Risk shows how brands can reduce the risks of depending on Facebook too much.

In the Facebook As Investment trilogy, I have analyzed several dimensions of investing in Facebook and raised my doubts about the company’s management and direction. In Part Three, I’ll address how brand executives can insulate themselves from Facebook’s—or any platform’s—fortunes by moving to make their relationships and networks portable. By making and managing investments carefully, brands’ relationships will endure regardless of platforms’ destinies.

By the way, Part One examined how Facebook’s trust gap would make it difficult for Facebook to fully monetize its considerable assets. Part Two analyzed Facebook as a social platform and revealed that it had no competitive threats from other pureplays; rather, the risk was that the whole pureplay category would lose its dominance in 3-5 years.

[…]

|

|

![]() When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment.

When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment.

By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment.

By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment. The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship.

The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship. This week Twitter and LinkedIn canceled their agreement for easy cross-posting, which begot numerous indignant comments from people who seemed to have forgotten that they were using free infrastructure. Social business platforms are built and managed by venture-backed firms that need to execute on evolving business models, so we can all expect sudden changes from any and all. However, with some foresight and preparation you and your firm can minimize disruptions, which we’ll cover here. Even better, the LinkedIn-Twitter dustup provides strategic insights into how to operate within the digital social ecosystem, and we’ll address those, too.

This week Twitter and LinkedIn canceled their agreement for easy cross-posting, which begot numerous indignant comments from people who seemed to have forgotten that they were using free infrastructure. Social business platforms are built and managed by venture-backed firms that need to execute on evolving business models, so we can all expect sudden changes from any and all. However, with some foresight and preparation you and your firm can minimize disruptions, which we’ll cover here. Even better, the LinkedIn-Twitter dustup provides strategic insights into how to operate within the digital social ecosystem, and we’ll address those, too. I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).

I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).