It is exciting to see widening recognition that brand survival depends on improving the lives of customers, not merely “pushing product” as they are accustomed to doing. In the latest example, Business Should Focus on Sociality, Not Social “Media”, Umair Haque offered a case for the end of social media and the disruption of many Industrial Economy structures, namely the social contract. It is exciting to see widening recognition that brand survival depends on improving the lives of customers, not merely “pushing product” as they are accustomed to doing. In the latest example, Business Should Focus on Sociality, Not Social “Media”, Umair Haque offered a case for the end of social media and the disruption of many Industrial Economy structures, namely the social contract.

As regular readers well know, I agree with Haque’s key thesis, that brands need to jettison their legacy focus on products/services in favor of dedicating themselves to helping users achieve outcomes while using their products. I have often written that humans and their organizations will have to adopt a more collaborative and responsible attitude and approach in general. However, I don’t agree with him that there’s only one way to do “sociality” as he implies by his assertion that brands have an “existential responsibility” to “the art of living.” Here I’ll explain the differences, which will help brand stewards understand the nuances of brands’ disruption.

[…]

I covered the Federal Reserve Bank of Chicago Economic Forecast last week, where all speakers issued this refrain: “More of the same.” Key economic indicators have been stuck in neutral—the proverbial “sideways” movement—so the consensus in the room was one of faint frustration tempered by gratitude. Everyone had lived through worse. I covered the Federal Reserve Bank of Chicago Economic Forecast last week, where all speakers issued this refrain: “More of the same.” Key economic indicators have been stuck in neutral—the proverbial “sideways” movement—so the consensus in the room was one of faint frustration tempered by gratitude. Everyone had lived through worse.

The current “recovery” is underperforming any other in recent memory according to many measures, especially employment.

The conference was very well organized and featured expert presenters. Reading between the lines, I perceive significant opportunity that will surprise most people. After my notes of speakers’ remarks, I’ll share my thoughts on 2013’s opportunity that is evident when one regards “the economy” from a different point of view.

Everyone wonders what kind of presents we will open in 2013 (right).

[…]

[UPDATED] Several profound market forces are preparing the ascendancy of Knowledge Economy products, which result from collaboration among designers, artists, engineers, customers and firms. This represents one of the Knowledge Economy’s most exciting-yet-disruptive elements: “products” will cease to be dominated by monolithic factories that mass produce virtually all items that people use and consume. Moreover, people have an inherent joy when they can make things for themselves, their friends and their families—and a dramatic new wave of creativity and innovation is imminent. To help you wrap your mind around Knowledge Economy products, this post will recall what happened to mass media and entertainment industries. [UPDATED] Several profound market forces are preparing the ascendancy of Knowledge Economy products, which result from collaboration among designers, artists, engineers, customers and firms. This represents one of the Knowledge Economy’s most exciting-yet-disruptive elements: “products” will cease to be dominated by monolithic factories that mass produce virtually all items that people use and consume. Moreover, people have an inherent joy when they can make things for themselves, their friends and their families—and a dramatic new wave of creativity and innovation is imminent. To help you wrap your mind around Knowledge Economy products, this post will recall what happened to mass media and entertainment industries.

Knowledge Economy products are conceived, designed, prototyped and fabricated in the Social Channel. Best practices in open source, Agile development, design and Web development will unleash continuous innovation at a scale and pace we’ve never seen before. Knowledge and innovation will be free in the Knowledge Economy because all supporting processes will become an order of magnitude faster and cheaper. Firms and brands that do not recognize and respond quickly enough will become irrelevant.

Most brands […]

Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it. Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it.

[…]

Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid. Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid.

Next Door’s main online presence is oriented toward free membership. Members can book space, sign up for classes and hold events. Here’s IDEO’s case study on the concept and design process.

[…]

When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment. When CSRA released the Social Network Roadmap in Q2 2008, we were a unique voice speaking at conferences about enterprise adoption. Due to my prior work helping enterprises adopt disruptive technologies like distributed computing, Web applications, service-oriented architecture and Web services, it was easy to see what enterprise adoption would look like, so I designed Social Network Roadmap several years before most of the market was ready to use it. Our client work has enabled us to test, tweak and expand the roadmap since then. As 2012 draws to a close, enterprises have experimented, adoption of social technologies (“social media”) among most stakeholders has set records, and executives wonder how they can coordinate social business across the enterprise. To realize “compounded” enterprise social business benefits it’s important to understand the social business life cycle, so here is a brief treatment.

[…]

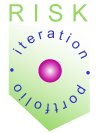

How to Outperform by Managing the Social Business Risks that Slow Your Competitors

By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment. By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment.

[…]

Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows. Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows.

What does this mean for branches? I’ll offer a surprising alternative.

[…]

Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter. Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The point remains, imagination and inertia are preventing financial services firms from engaging with clients and prospects in digital social venues, not regulators. Here’s how it’s done.

[…]

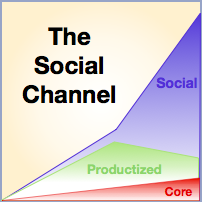

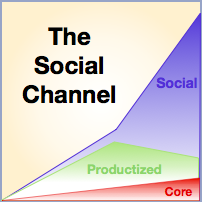

The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship. The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship.

Since the Social Channel is so important, I have published the Social Channel Trilogy, which is summarized here. Find even more information on the Social Channel home page.

[…]

|

|

It is exciting to see widening recognition that brand survival depends on improving the lives of customers, not merely “pushing product” as they are accustomed to doing. In the latest example, Business Should Focus on Sociality, Not Social “Media”, Umair Haque offered a case for the end of social media and the disruption of many Industrial Economy structures, namely the social contract.

It is exciting to see widening recognition that brand survival depends on improving the lives of customers, not merely “pushing product” as they are accustomed to doing. In the latest example, Business Should Focus on Sociality, Not Social “Media”, Umair Haque offered a case for the end of social media and the disruption of many Industrial Economy structures, namely the social contract.

I covered the Federal Reserve Bank of Chicago Economic Forecast last week, where all speakers issued this refrain: “More of the same.” Key economic indicators have been stuck in neutral—the proverbial “sideways” movement—so the consensus in the room was one of faint frustration tempered by gratitude. Everyone had lived through worse.

I covered the Federal Reserve Bank of Chicago Economic Forecast last week, where all speakers issued this refrain: “More of the same.” Key economic indicators have been stuck in neutral—the proverbial “sideways” movement—so the consensus in the room was one of faint frustration tempered by gratitude. Everyone had lived through worse. [UPDATED] Several profound market forces are preparing the ascendancy of Knowledge Economy products, which result from collaboration among designers, artists, engineers, customers and firms. This represents one of the Knowledge Economy’s most exciting-yet-disruptive elements: “products” will cease to be dominated by monolithic factories that mass produce virtually all items that people use and consume. Moreover, people have an inherent joy when they can make things for themselves, their friends and their families—and a dramatic new wave of creativity and innovation is imminent. To help you wrap your mind around Knowledge Economy products, this post will recall what happened to mass media and entertainment industries.

[UPDATED] Several profound market forces are preparing the ascendancy of Knowledge Economy products, which result from collaboration among designers, artists, engineers, customers and firms. This represents one of the Knowledge Economy’s most exciting-yet-disruptive elements: “products” will cease to be dominated by monolithic factories that mass produce virtually all items that people use and consume. Moreover, people have an inherent joy when they can make things for themselves, their friends and their families—and a dramatic new wave of creativity and innovation is imminent. To help you wrap your mind around Knowledge Economy products, this post will recall what happened to mass media and entertainment industries. Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it.

Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it. Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid.

Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid. By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment.

By understanding the dirty dozen social business risks, you can make fewer mistakes than your rivals and get more done for less money, so this may be one of the most valuable posts you read this year. Having advised executives in adopting disruptive technology since the 1980s, I have learned that hidden assumptions sabotage early adopters’ investments and delay desired business outcomes. Happily, early adopters can significantly diminish social business risks by looking for them and mitigating them with agile development methodologies. CSRA’s client work has shown that using a risk mitigation approach is the most effective way to increase social business return on investment. The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship.

The Social Channel of Value explains our era’s drivers of economic transformation and how leaders can use them to strengthen their careers, organizations and communities. Profound shifts in human beings’ means of production restructure society and business because they alter the amount of “value” human work can create as well as the type of “products” that encapsulate people’s work. Individuals and organizations that notice, observe and understand these shifts early on can improve their relevance and competitiveness. Many of those that do not respond quickly enough go down with the ship.