CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale. CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

If you’d like to watch this post instead, just click the thumbnail button.

[…]

Bill Snyder at Infoworld posted some amazing statistics that support the end of social media as we know it, which I predicted in 2009. Marketing and public relations have been losing influence for years because they are impersonal, and people prefer personalized interactions (deep dive here), so marketers and their vendors are grasping at straws. In this context, “social media” has generally been practiced as a shallow promotional activity, and my premise in predicting its demise is that the true potential of social technologies is creating and maintaining relationships, which are based on personalized attention and caring. Bill Snyder at Infoworld posted some amazing statistics that support the end of social media as we know it, which I predicted in 2009. Marketing and public relations have been losing influence for years because they are impersonal, and people prefer personalized interactions (deep dive here), so marketers and their vendors are grasping at straws. In this context, “social media” has generally been practiced as a shallow promotional activity, and my premise in predicting its demise is that the true potential of social technologies is creating and maintaining relationships, which are based on personalized attention and caring.

[…]

Recent coverage has increased my doubts in Facebook’s management team, whose failure to capitalize on its unique assets looks increasingly likely. In the Facebook As Investment trilogy, I examined Facebook through three different lenses and voiced my doubts about its management team’s ability to realize the company’s fantastic potential. Many of CSRA’s clients have invested significantly in Facebook presences, and I am not predicting the site’s demise, but I question its long-term viability. Brands face two types of immediate risk: erratic technology/functionality changes to “add value” with features—and lack of innovation due to management team paralysis. Facebook Page owners and individual users may be inconvenienced, but nothing drastic will happen right away. As a related issue, Facebook’s experience may presage a Web 2.0 startup bubble bursting. After a summary of danger signs, I’ll recommend how you can minimize your inconvenience due to Facebook’s gyrations. Recent coverage has increased my doubts in Facebook’s management team, whose failure to capitalize on its unique assets looks increasingly likely. In the Facebook As Investment trilogy, I examined Facebook through three different lenses and voiced my doubts about its management team’s ability to realize the company’s fantastic potential. Many of CSRA’s clients have invested significantly in Facebook presences, and I am not predicting the site’s demise, but I question its long-term viability. Brands face two types of immediate risk: erratic technology/functionality changes to “add value” with features—and lack of innovation due to management team paralysis. Facebook Page owners and individual users may be inconvenienced, but nothing drastic will happen right away. As a related issue, Facebook’s experience may presage a Web 2.0 startup bubble bursting. After a summary of danger signs, I’ll recommend how you can minimize your inconvenience due to Facebook’s gyrations.

[…]

How Brands Cut Their Exposure to Facebook Business Risk shows how brands can reduce the risks of depending on Facebook too much.

In the Facebook As Investment trilogy, I have analyzed several dimensions of investing in Facebook and raised my doubts about the company’s management and direction. In Part Three, I’ll address how brand executives can insulate themselves from Facebook’s—or any platform’s—fortunes by moving to make their relationships and networks portable. By making and managing investments carefully, brands’ relationships will endure regardless of platforms’ destinies.

By the way, Part One examined how Facebook’s trust gap would make it difficult for Facebook to fully monetize its considerable assets. Part Two analyzed Facebook as a social platform and revealed that it had no competitive threats from other pureplays; rather, the risk was that the whole pureplay category would lose its dominance in 3-5 years.

[…]

Facebook As Investment: No Replacement for Facebook But Pureplays Will Fade shows how the fading importance of social networks is the threat—not competitors. In Part One of the Facebook As Investment trilogy, I argued that Facebook had a signifiant trust gap with users that would inhibit its ability to monetize its most unique and valuable assets, and that the trust gap was recently compounded by its “IPO irregularities.” In Part Two, I’ll take a different tack and analyze the investment prospects of Facebook-the-platform. Part Three advises executives on how to isolate their social business investments from Facebook business risks. Facebook As Investment: No Replacement for Facebook But Pureplays Will Fade shows how the fading importance of social networks is the threat—not competitors. In Part One of the Facebook As Investment trilogy, I argued that Facebook had a signifiant trust gap with users that would inhibit its ability to monetize its most unique and valuable assets, and that the trust gap was recently compounded by its “IPO irregularities.” In Part Two, I’ll take a different tack and analyze the investment prospects of Facebook-the-platform. Part Three advises executives on how to isolate their social business investments from Facebook business risks.

In its favor, Facebook will not have to worry about being “displaced” by another social network the way that it displaced MySpace. In the near term, this lack of competition will give the company some breathing room. However, a more daunting threat awaits, the end of the social network pureplay, but that is 3-5 years out.

Nonetheless, the fate of pureplays should be top-of-mind for serious Facebook investors: to produce the fabulous returns that […]

Facebook As Investment: How Trust Issues Block Its Best Path to Wealth describes why Facebook needs to change its orientation to users to unlock its full wealth potential. Over the past month, it has been de rigeur to comment on Facebook’s IPO and “quality” as an investment, but I decided to hold back until I could free a window to consider the matter in sufficient detail. The result is the “Facebook As Investment” trilogy, of which this is the first part. Part Two analyzes Facebook-the-platform’s investment prospects. Part Three advises executives on how to isolate their social business investments from Facebook business risks. Facebook As Investment: How Trust Issues Block Its Best Path to Wealth describes why Facebook needs to change its orientation to users to unlock its full wealth potential. Over the past month, it has been de rigeur to comment on Facebook’s IPO and “quality” as an investment, but I decided to hold back until I could free a window to consider the matter in sufficient detail. The result is the “Facebook As Investment” trilogy, of which this is the first part. Part Two analyzes Facebook-the-platform’s investment prospects. Part Three advises executives on how to isolate their social business investments from Facebook business risks.

I did not buy into Facebook and do not plan to invest in its stock. I think it is a fantastic social venue and platform in which to connect with people (“stakeholders,” friends, associates..)—personally and for enterprises and brands. However, as I’ll argue here, Facebook‘s Achilles heel is a significant trust gap with most of its stakeholders. Its trust gap will make it difficult for Facebook management to fully […]

Facebook recently released a new control for Pages that acts like blogs’ pre-moderation setting: when a Page admin activates it, Likes’ (Fans’) “organic” posts will not appear on the Page’s Wall until an admin specifically approves them. Read on for how to decide whether to use this control with your Pages as well as my interpretation of how the new control helps to reveal Facebook’s emerging business strategy to maximize the impact of its IPO. Facebook recently released a new control for Pages that acts like blogs’ pre-moderation setting: when a Page admin activates it, Likes’ (Fans’) “organic” posts will not appear on the Page’s Wall until an admin specifically approves them. Read on for how to decide whether to use this control with your Pages as well as my interpretation of how the new control helps to reveal Facebook’s emerging business strategy to maximize the impact of its IPO.

[…]

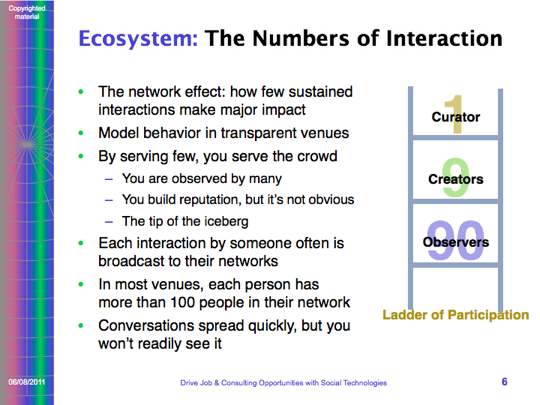

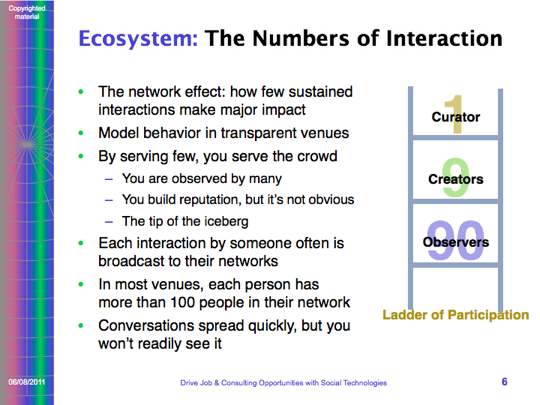

Most of us are familiar with Forrester’s Ladder of Participation, but using it to build engagement and community still escapes most individuals and organizations, so here I’ll offer a short treatment within the context of Facebook [click graphic right to enlarge]. The profound insight is that 90% of people in a social venue observe without interacting. 9% are the creators, they tweet, blog and make themselves known. 1% are curators, they sort and categorize content. Whether you are on LinkedIn, Facebook or authoring a blog, you only hear 10% of the people, but you are affecting 100% of the people. If you don’t know that, you might think your online activities were going unnoticed. Now I’ll turn to how this works in Facebook.

[…]

How Social Actions Have Pulled the Rug from under Banner Ads

Facebook’s development schedule epitomizes the “white water, fast iteration” approach to serving company and customer. Although its mishaps are legendary, it succeeds in consistently fielding a mind-numbing array of features, so it is difficult to keep up and very easy to miss the significance of things. To whit, very few people people have noticed that Facebook has quietly revolutionized banner ads through a feature that is maligned by users but gold for marketers. This feature has created two opportunities for e-commerce marketers: a new means of inexpensive market research and an easy way to improve relationships with their viewers. Read on to do this to your competitors before they do it to you. Facebook’s development schedule epitomizes the “white water, fast iteration” approach to serving company and customer. Although its mishaps are legendary, it succeeds in consistently fielding a mind-numbing array of features, so it is difficult to keep up and very easy to miss the significance of things. To whit, very few people people have noticed that Facebook has quietly revolutionized banner ads through a feature that is maligned by users but gold for marketers. This feature has created two opportunities for e-commerce marketers: a new means of inexpensive market research and an easy way to improve relationships with their viewers. Read on to do this to your competitors before they do it to you.

[…]

In Allfacebook, Nick O’Neill presents a chart that compares the first six years’ revenue for Yahoo!, Google and Facebook. Even though some of these exercises are coffee-cooler talk without much substance, this one afforded the opportunity to think about how Facebook and Google add value. In Allfacebook, Nick O’Neill presents a chart that compares the first six years’ revenue for Yahoo!, Google and Facebook. Even though some of these exercises are coffee-cooler talk without much substance, this one afforded the opportunity to think about how Facebook and Google add value.

According to BusinessInsider’s interpretation, neither Google nor Facebook emphasized revenue in the early years and hockey-sticked later. Here’s the article, and here are my thoughts on all three players:

[…]

|

|

CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

Bill Snyder at Infoworld posted some amazing statistics that support the end of social media as we know it, which I predicted in 2009. Marketing and public relations have been losing influence for years because they are impersonal, and people prefer personalized interactions (deep dive here), so marketers and their vendors are grasping at straws. In this context, “social media” has generally been practiced as a shallow promotional activity, and my premise in predicting its demise is that the true potential of social technologies is creating and maintaining relationships, which are based on personalized attention and caring.

Bill Snyder at Infoworld posted some amazing statistics that support the end of social media as we know it, which I predicted in 2009. Marketing and public relations have been losing influence for years because they are impersonal, and people prefer personalized interactions (deep dive here), so marketers and their vendors are grasping at straws. In this context, “social media” has generally been practiced as a shallow promotional activity, and my premise in predicting its demise is that the true potential of social technologies is creating and maintaining relationships, which are based on personalized attention and caring.