Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid. Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid.

Next Door’s main online presence is oriented toward free membership. Members can book space, sign up for classes and hold events. Here’s IDEO’s case study on the concept and design process.

[…]

Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows. Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows.

What does this mean for branches? I’ll offer a surprising alternative.

[…]

Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter. Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The point remains, imagination and inertia are preventing financial services firms from engaging with clients and prospects in digital social venues, not regulators. Here’s how it’s done.

[…]

Social Channel Three: Using the Social Channel to Defend Native Markets and Penetrate Foreign Markets

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value. The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value.

The blade cuts both ways: the home court advantage will make exporting to emerging markets much more difficult in the years ahead. The Social Channel will raise the bar because users in all markets will increasingly expect brands to relate to them and to solicit their input and advice. Brands will have to invest significantly in developing in-market social […]

Social Channel Two: Understanding the Social Channel of Value by Examining Its Precedents

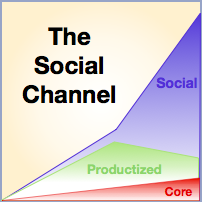

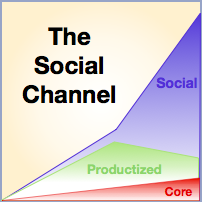

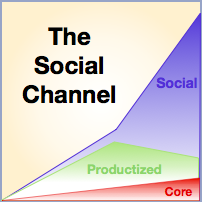

Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them. Meet the Social Channel of Value, the new arena where brands compete for user (customer, client) attention and loyalty. Product features are losing their ability to differentiate because they are copied so easily. Moreover, the Social Channel of Value will transform human decision-making, organizations and institutions because it digitizes sociality, a core human trait, and its power will dwarf the power of the product and the brand. CEOs, CMOs and CPOs have a very rare social business opportunity to harness the Social Channel ahead of competitors and remake their markets. These are strong statements, but bear with me and I think you’ll appreciate why I’ve made them.

The Social Channel is the Knowledge Economy‘s analog to the Industrial Economy’s assembly line, which led to today’s brands and mass-produced products. Where the assembly line made fabrication ten times more efficient, digital social technologies will boost human communication and sociality by an order of magnitude. The “Social Channel of Value” shows how product and service features will […]

Nonprofits’ and NGOs’ use of street marketing and social media reveals how mission too often overshadows relationship building—and alienates more people than it attracts.

In How Nonprofits & NGOs Can Press Their Home Court Advantage in Social Business, I explained how nonprofits had a significant “moral advantage” over commercial enterprises because they were cause-focused, which is inherently more attractive to most people than business focus. However, as I’ll explain here, too many NFPs apply their moral advantage in the wrong way, so it creates more negative than positive impressions. I’ll use the tangible example of street marketing to make the point before applying it to social business/social media. In How Nonprofits & NGOs Can Press Their Home Court Advantage in Social Business, I explained how nonprofits had a significant “moral advantage” over commercial enterprises because they were cause-focused, which is inherently more attractive to most people than business focus. However, as I’ll explain here, too many NFPs apply their moral advantage in the wrong way, so it creates more negative than positive impressions. I’ll use the tangible example of street marketing to make the point before applying it to social business/social media.

[…]

I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”). I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).

In this context, government usually lies between nonprofits and brands because it’s not commercially focused (advantage), but it rarely considers individuals in meaningful ways (disadvantage). Here I’ll lay out the rationale for these claims before giving some practical pointers for unlocking social business potential by understanding the social good of your business. Brands and governments, you can learn from this, too.

[…]

How Brands Cut Their Exposure to Facebook Business Risk shows how brands can reduce the risks of depending on Facebook too much.

In the Facebook As Investment trilogy, I have analyzed several dimensions of investing in Facebook and raised my doubts about the company’s management and direction. In Part Three, I’ll address how brand executives can insulate themselves from Facebook’s—or any platform’s—fortunes by moving to make their relationships and networks portable. By making and managing investments carefully, brands’ relationships will endure regardless of platforms’ destinies.

By the way, Part One examined how Facebook’s trust gap would make it difficult for Facebook to fully monetize its considerable assets. Part Two analyzed Facebook as a social platform and revealed that it had no competitive threats from other pureplays; rather, the risk was that the whole pureplay category would lose its dominance in 3-5 years.

[…]

Facebook As Investment: No Replacement for Facebook But Pureplays Will Fade shows how the fading importance of social networks is the threat—not competitors. In Part One of the Facebook As Investment trilogy, I argued that Facebook had a signifiant trust gap with users that would inhibit its ability to monetize its most unique and valuable assets, and that the trust gap was recently compounded by its “IPO irregularities.” In Part Two, I’ll take a different tack and analyze the investment prospects of Facebook-the-platform. Part Three advises executives on how to isolate their social business investments from Facebook business risks. Facebook As Investment: No Replacement for Facebook But Pureplays Will Fade shows how the fading importance of social networks is the threat—not competitors. In Part One of the Facebook As Investment trilogy, I argued that Facebook had a signifiant trust gap with users that would inhibit its ability to monetize its most unique and valuable assets, and that the trust gap was recently compounded by its “IPO irregularities.” In Part Two, I’ll take a different tack and analyze the investment prospects of Facebook-the-platform. Part Three advises executives on how to isolate their social business investments from Facebook business risks.

In its favor, Facebook will not have to worry about being “displaced” by another social network the way that it displaced MySpace. In the near term, this lack of competition will give the company some breathing room. However, a more daunting threat awaits, the end of the social network pureplay, but that is 3-5 years out.

Nonetheless, the fate of pureplays should be top-of-mind for serious Facebook investors: to produce the fabulous returns that […]

Facebook As Investment: How Trust Issues Block Its Best Path to Wealth describes why Facebook needs to change its orientation to users to unlock its full wealth potential. Over the past month, it has been de rigeur to comment on Facebook’s IPO and “quality” as an investment, but I decided to hold back until I could free a window to consider the matter in sufficient detail. The result is the “Facebook As Investment” trilogy, of which this is the first part. Part Two analyzes Facebook-the-platform’s investment prospects. Part Three advises executives on how to isolate their social business investments from Facebook business risks. Facebook As Investment: How Trust Issues Block Its Best Path to Wealth describes why Facebook needs to change its orientation to users to unlock its full wealth potential. Over the past month, it has been de rigeur to comment on Facebook’s IPO and “quality” as an investment, but I decided to hold back until I could free a window to consider the matter in sufficient detail. The result is the “Facebook As Investment” trilogy, of which this is the first part. Part Two analyzes Facebook-the-platform’s investment prospects. Part Three advises executives on how to isolate their social business investments from Facebook business risks.

I did not buy into Facebook and do not plan to invest in its stock. I think it is a fantastic social venue and platform in which to connect with people (“stakeholders,” friends, associates..)—personally and for enterprises and brands. However, as I’ll argue here, Facebook‘s Achilles heel is a significant trust gap with most of its stakeholders. Its trust gap will make it difficult for Facebook management to fully […]

|

|

Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid.

Next Door Chicago is a newish concept for State Farm Insurance that’s a great example of social business in insurance. It differentiates the firm by interacting in the Social Channel. The Lincoln Park/Lakeview community center and coworking space is notable because its DNA is empowering people to improve their lives through financial education. Next Door offers free coworking space and wifi, classes on financial management that are free of product pitches, free events (some financial, some art showings and other diverse events), free conference rooms and an energetic environment. Only the optional coffee bar is paid.

Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows.

Banks are under intensifying profit pressure, so all are reexamining the size and value of bank branch networks. In How Many Bank Branches Do We Need in the U.S., posted in Celent Banking Blog, Bob Meara offers a brief discussion of the concept of “branch flexing,” as coined by Oliver Wyman to describe optimization. It’s no surprise that banks are questioning their massive branch expansions during the 2000s, especially in light of increased capital requirements and regulatory costs, which increase cost of operations. Moreover, margins are razor thin as interest rates are at historic lows. The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value.

The global Social Channel will reintroduce “home court advantage” to national brands because those that use social business to compete globally by collaborating with users will have the cultural advantage; “foreign” firms may have better product features for the money, but they will not match home brands’ cultural fluency. Personalized service and attention are culturally specific, and deep cultural fluency directly correlates to intimacy. However, brands can only develop the home court advantage by practicing social business at an advanced level. Most have a long way to go and, meanwhile, they will get hammered when they persist in competing on product features in the Productized Channel of Value. In How Nonprofits & NGOs Can Press Their Home Court Advantage in Social Business, I explained how nonprofits had a significant “moral advantage” over commercial enterprises because they were cause-focused, which is inherently more attractive to most people than business focus. However, as I’ll explain here, too many NFPs apply their moral advantage in the wrong way, so it creates more negative than positive impressions. I’ll use the tangible example of street marketing to make the point before applying it to social business/social media.

In How Nonprofits & NGOs Can Press Their Home Court Advantage in Social Business, I explained how nonprofits had a significant “moral advantage” over commercial enterprises because they were cause-focused, which is inherently more attractive to most people than business focus. However, as I’ll explain here, too many NFPs apply their moral advantage in the wrong way, so it creates more negative than positive impressions. I’ll use the tangible example of street marketing to make the point before applying it to social business/social media. I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).

I have written often about various facets of social business disruption, which usually causes organizations angst because they have to learn to change how they do things. On a happier note, nonprofits and NGOs, long accustomed to being (relatively) disadvantaged do-gooders grateful for commercial bodies’ largesse, actually have more of an advantage in social business than commercial firms (“brands”).