CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale. CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

If you’d like to watch this post instead, just click the thumbnail button.

[…]

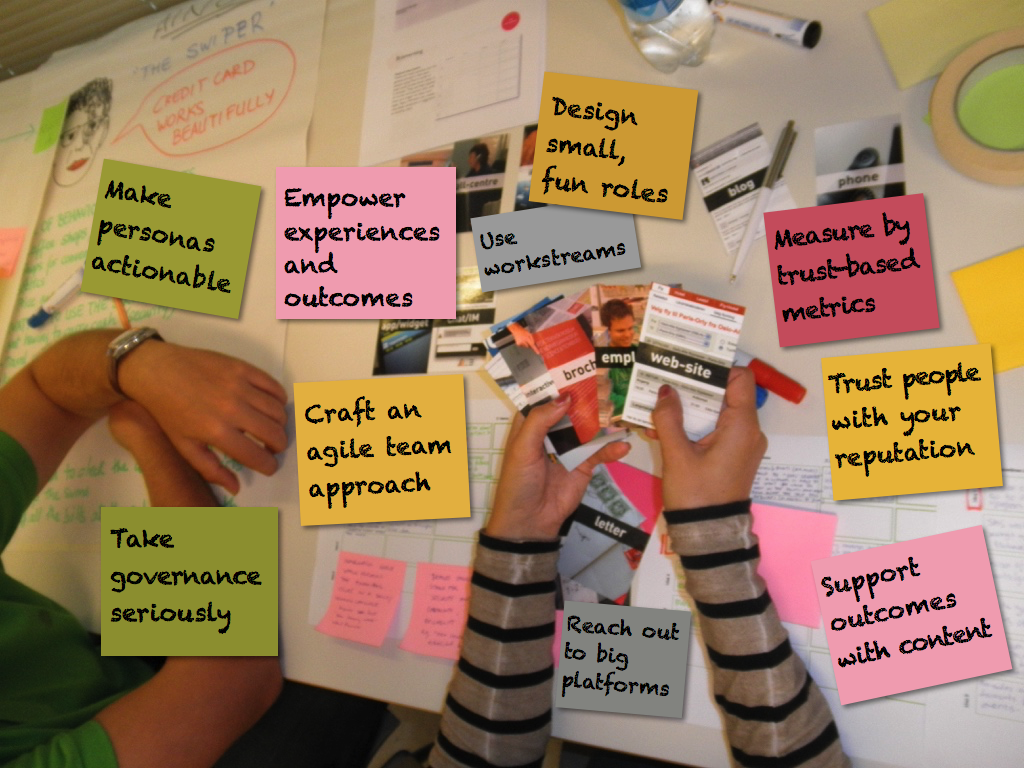

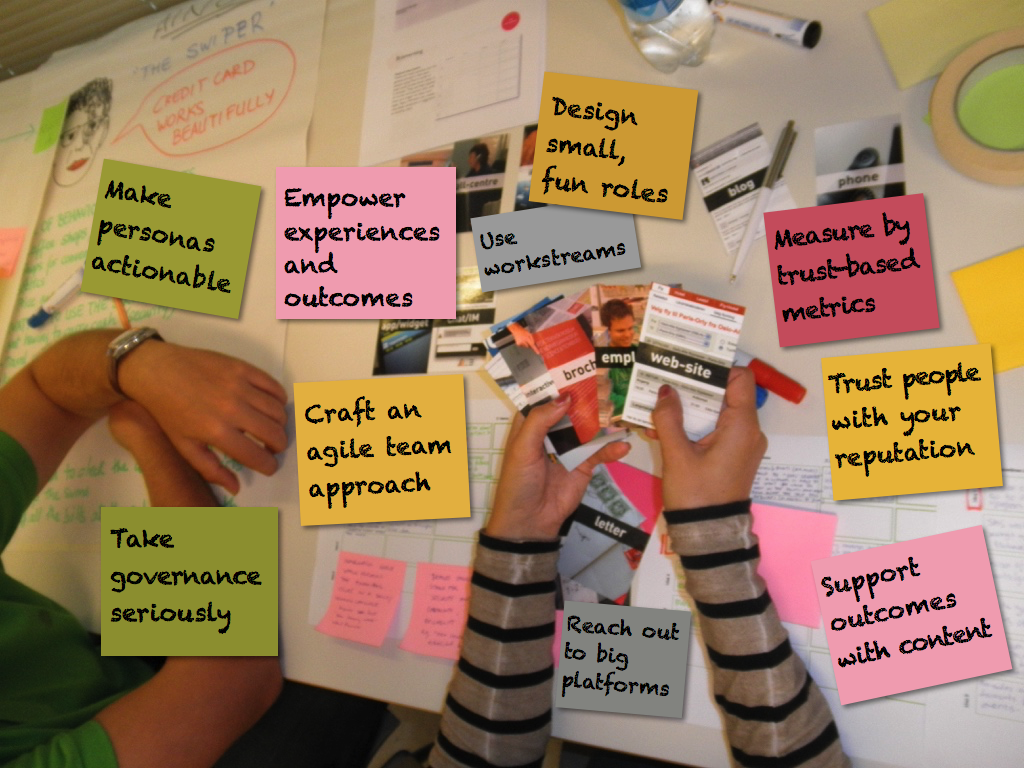

Social media strategy good practices is a short list of principles that can make your firm stand out when empowering customer and employee experience. It’s part of a talk I gave today to a large multidisciplinary team. Their venerable institution plans to use social media strategy to get the ducks in a row without too much squawking. The most exciting aspect of social media strategy is that there’s so much room for improvement: while your peers and competitors are trying to “engage” with finely crafted-yet-impersonal content, you can power past them using experiential social media, which focuses on scalable interaction.

Here are the cliff notes to the good practices part of our discussion:

[…]

[UPDATED] Several times over the past few years, I have been contacted by major brands to advise them on finding a “social media executive” to help them “figure out social media” and “create a strategy.” In 2012, many firms began building social media teams in earnest, and this trend will continue to grow in the years ahead. Firms are also bringing “social media work” inside after having outsourced it to agencies. All of my client work has involved helping clients to build social business competency and teams, so here I’ll offer some pointers for how to build teams and avoid the pitfalls most companies experience. [UPDATED] Several times over the past few years, I have been contacted by major brands to advise them on finding a “social media executive” to help them “figure out social media” and “create a strategy.” In 2012, many firms began building social media teams in earnest, and this trend will continue to grow in the years ahead. Firms are also bringing “social media work” inside after having outsourced it to agencies. All of my client work has involved helping clients to build social business competency and teams, so here I’ll offer some pointers for how to build teams and avoid the pitfalls most companies experience.

Although each organization’s culture is different, the CEO, CDO, CMO or CAO will be happier with the social business investment if s/he doesn’t invest far ahead of return on investment, which remains low at firms that insist on “business-meaningful” metrics, not the PR- or “brand-building” variety. It’s a chicken-and-egg challenge: how do you know what kind of team to build until you’re achieving real business-meaningful returns on your social business initiatives?

[…]

You can create more opportunity with a career mission, especially when you don’t get distracted by traditional career or job search concerns like whether you have a “consulting” or “employment” relationship. Here I’ll share how you can create far more opportunity by changing your assumptions about work, tapping the Social Channel and aligning yourself with the emerging Knowledge Economy. To illustrate the point, I’ll use myself as an example because I’m a veteran of many types of “work arrangements.”

It’s the good news-bad news story of the almost-decade: legacy “work” and “jobs” have permanently gone by the wayside as the primary means for people to be productive in “modern” economies (bad news). However, people can create a higher quality of life by adopting a more flexible approach to work, and organizations are crying out for flexibility (good news).

[…]

Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it. Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it.

[…]

Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter. Putnam Investments has been a financial services social business pioneer for many years, so here I’ll summarize their pioneering initiatives that show that regulated financial services firms can communicate with clients and prospects in many-to-many social venues without going astray. True, it helps having a CEO that was the first CEO from a mutual funds firm on Twitter.

The point remains, imagination and inertia are preventing financial services firms from engaging with clients and prospects in digital social venues, not regulators. Here’s how it’s done.

[…]

Recent coverage has increased my doubts in Facebook’s management team, whose failure to capitalize on its unique assets looks increasingly likely. In the Facebook As Investment trilogy, I examined Facebook through three different lenses and voiced my doubts about its management team’s ability to realize the company’s fantastic potential. Many of CSRA’s clients have invested significantly in Facebook presences, and I am not predicting the site’s demise, but I question its long-term viability. Brands face two types of immediate risk: erratic technology/functionality changes to “add value” with features—and lack of innovation due to management team paralysis. Facebook Page owners and individual users may be inconvenienced, but nothing drastic will happen right away. As a related issue, Facebook’s experience may presage a Web 2.0 startup bubble bursting. After a summary of danger signs, I’ll recommend how you can minimize your inconvenience due to Facebook’s gyrations. Recent coverage has increased my doubts in Facebook’s management team, whose failure to capitalize on its unique assets looks increasingly likely. In the Facebook As Investment trilogy, I examined Facebook through three different lenses and voiced my doubts about its management team’s ability to realize the company’s fantastic potential. Many of CSRA’s clients have invested significantly in Facebook presences, and I am not predicting the site’s demise, but I question its long-term viability. Brands face two types of immediate risk: erratic technology/functionality changes to “add value” with features—and lack of innovation due to management team paralysis. Facebook Page owners and individual users may be inconvenienced, but nothing drastic will happen right away. As a related issue, Facebook’s experience may presage a Web 2.0 startup bubble bursting. After a summary of danger signs, I’ll recommend how you can minimize your inconvenience due to Facebook’s gyrations.

[…]

In Recruiting Reinvented, the CEO of Reppify, which advises firms on using social networks to find job candidates, shared several nuggets for candidates, with a glaring omission that I’ll reveal below. Keep in mind that the focus of the interview was on how firms could use social to up their game, so the nuggets went unnoticed, except over here! One of Reppify’s core offerings is advising firms to use social networks to discover and engage candidates, but without setting off any legal land mines. I’m assuming that Reppify, in addition to screening candidates for clients, creates templated workstreams for their clients to improve recruiting while reducing risk. In Recruiting Reinvented, the CEO of Reppify, which advises firms on using social networks to find job candidates, shared several nuggets for candidates, with a glaring omission that I’ll reveal below. Keep in mind that the focus of the interview was on how firms could use social to up their game, so the nuggets went unnoticed, except over here! One of Reppify’s core offerings is advising firms to use social networks to discover and engage candidates, but without setting off any legal land mines. I’m assuming that Reppify, in addition to screening candidates for clients, creates templated workstreams for their clients to improve recruiting while reducing risk.

[…]

Top B2B Salesperson Trust Killers Revealed discusses the results of targeted B2B sales research I conducted on LinkedIn and features comments from many survey respondents.

One of the key takeaways of The Dynamics of Change video was trust’s importance to B2B prospects’ risk management practices. To explore trust’s importance to B2B sales, I surveyed dozens of seasoned B2B sales executives, including clients and salespeople, in this LinkedIn Poll. The results reveal the nuances of trust and how salespeople must constantly challenge themselves to focus on trust, relationship and execution. For example, respondents said that too many salespeople fumble the ball on fundamentals.

B2B sales is a challenging proposition in normal times, but the challenging global economic malaise has only made budgets tighter and sales more daunting. In large B2B deals, salespeople have to build a significant level of trust with prospects before any deal can be done. This analysis aims to help firm executives and sales leaders improve performance by increasing trust with prospects and clients.

[…]

How Brands Cut Their Exposure to Facebook Business Risk shows how brands can reduce the risks of depending on Facebook too much.

In the Facebook As Investment trilogy, I have analyzed several dimensions of investing in Facebook and raised my doubts about the company’s management and direction. In Part Three, I’ll address how brand executives can insulate themselves from Facebook’s—or any platform’s—fortunes by moving to make their relationships and networks portable. By making and managing investments carefully, brands’ relationships will endure regardless of platforms’ destinies.

By the way, Part One examined how Facebook’s trust gap would make it difficult for Facebook to fully monetize its considerable assets. Part Two analyzed Facebook as a social platform and revealed that it had no competitive threats from other pureplays; rather, the risk was that the whole pureplay category would lose its dominance in 3-5 years.

[…]

|

|

CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

CSRA milestones reflects on my first ten years of experiential social media, seen through the eyes of clients I’ve served. I’ll share what I learned about what outcomes we got in each engagement as well as how it happened that I developed and pioneered experiential, which if a repeatable process for developing trust and profit at scale.

[UPDATED] Several times over the past few years, I have been contacted by major brands to advise them on finding a “social media executive” to help them “figure out social media” and “create a strategy.” In 2012, many firms began building social media teams in earnest, and this trend will continue to grow in the years ahead. Firms are also bringing “social media work” inside after having outsourced it to agencies. All of my client work has involved helping clients to build social business competency and teams, so here I’ll offer some pointers for how to build teams and avoid the pitfalls most companies experience.

[UPDATED] Several times over the past few years, I have been contacted by major brands to advise them on finding a “social media executive” to help them “figure out social media” and “create a strategy.” In 2012, many firms began building social media teams in earnest, and this trend will continue to grow in the years ahead. Firms are also bringing “social media work” inside after having outsourced it to agencies. All of my client work has involved helping clients to build social business competency and teams, so here I’ll offer some pointers for how to build teams and avoid the pitfalls most companies experience.

Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it.

Branch disruption enables unusual opportunity for bank executives who consider transforming their relationships with clients. More generally, retail banking provides an excellent example of an Industrial Economy industry whose services are facing commoditization and weakening profits due to the waning of the Productized Channel of Value. In 2013, bank branch networks are under intense scrutiny because they are expensive, and client visits have been falling steadily for several years as e-banking and m-banking adoption have accelerated. Astute banks will use branches to transform their client relationships by leveraging the Social Channel. Here’s how they will do it. In Recruiting Reinvented, the CEO of Reppify, which advises firms on using social networks to find job candidates, shared several nuggets for candidates, with a glaring omission that I’ll reveal below. Keep in mind that the focus of the interview was on how firms could use social to up their game, so the nuggets went unnoticed, except over here! One of Reppify’s core offerings is advising firms to use social networks to discover and engage candidates, but without setting off any legal land mines. I’m assuming that Reppify, in addition to screening candidates for clients, creates templated workstreams for their clients to improve recruiting while reducing risk.

In Recruiting Reinvented, the CEO of Reppify, which advises firms on using social networks to find job candidates, shared several nuggets for candidates, with a glaring omission that I’ll reveal below. Keep in mind that the focus of the interview was on how firms could use social to up their game, so the nuggets went unnoticed, except over here! One of Reppify’s core offerings is advising firms to use social networks to discover and engage candidates, but without setting off any legal land mines. I’m assuming that Reppify, in addition to screening candidates for clients, creates templated workstreams for their clients to improve recruiting while reducing risk.